WTE in General

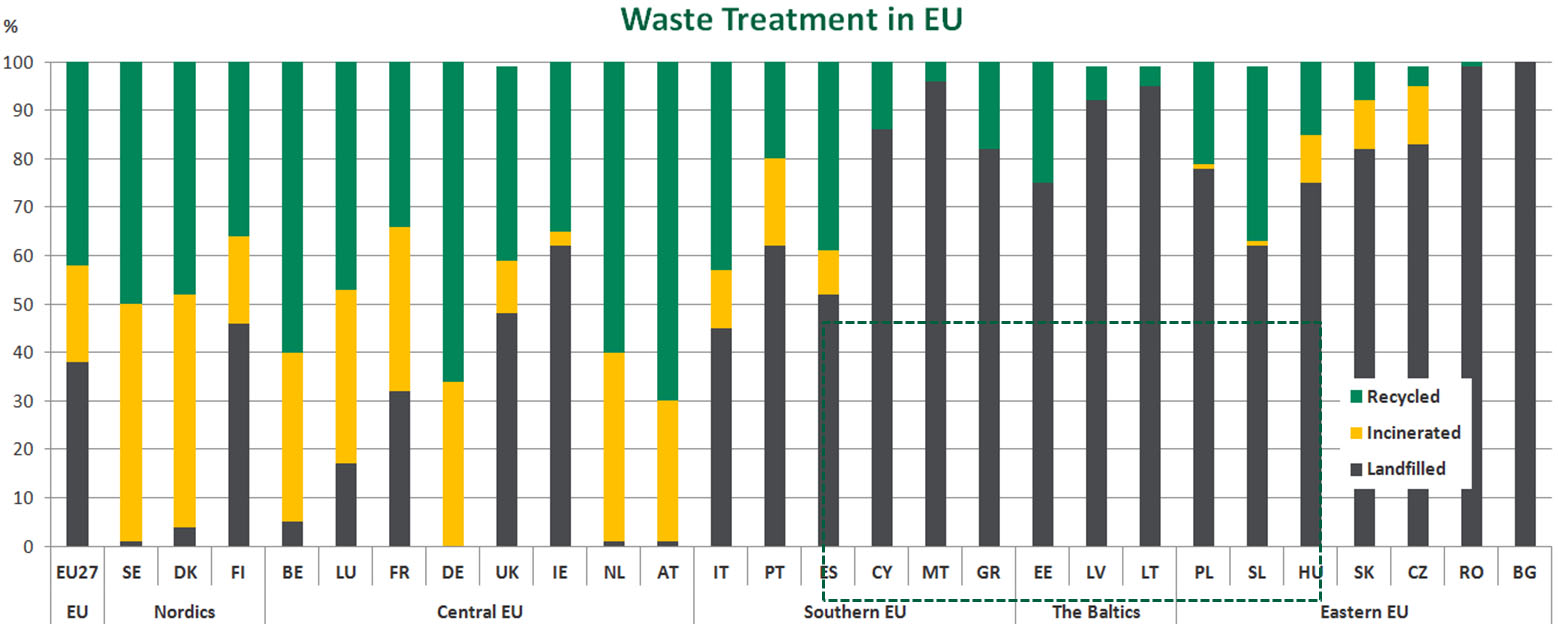

There is a large need for waste treatment in Eastern Europe – Most countries have renewable targets that are unfulfilled.

Eastern Europe will have to implement the Landfill Directive (EU’s and or other) as every other country has. This results in a large potential for the construction of new WtE facilities.

– Waste Management World

Investment Considerations

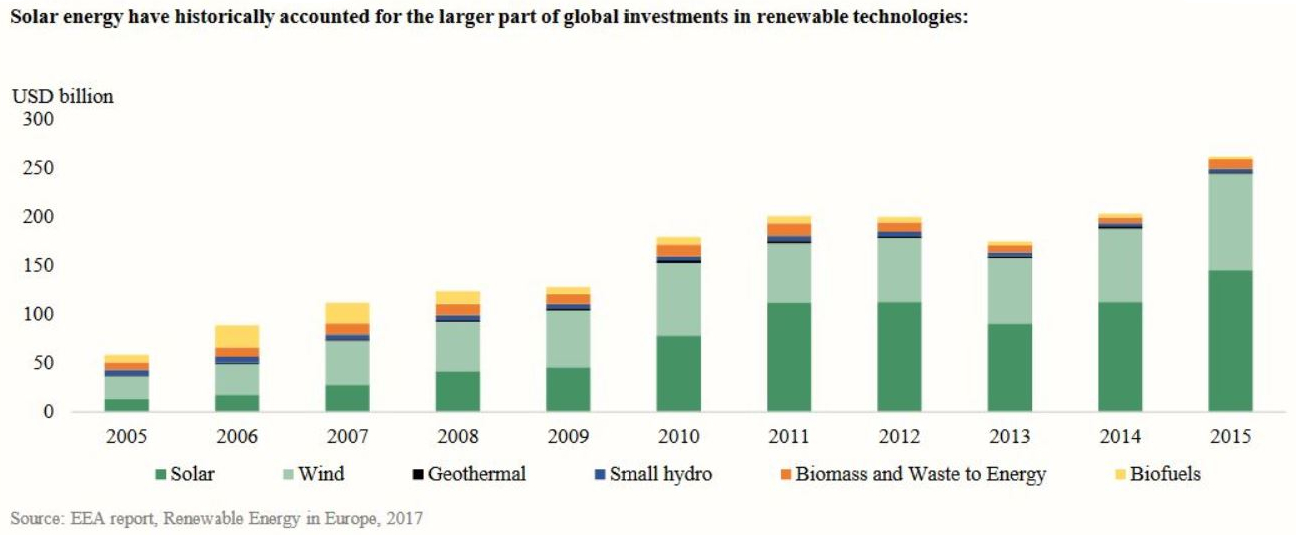

Renewable energy is still, despite its massive growth over the last decade and the impact of the financial crisis in Europe and the US, the most dynamic investment field for both yield and value investors.

- The yields in the broader fixed income markets have over a long period been at historical lows, driving investors in to exotic alternatives to get needed returns.

- The volatility of the stock market, in combination with placement restrictions, is driving long-term money in search of other sources of business. Energy production is to a great degree not correlated to other asset classes.

- Attractive risk-adjusted returns, low volatility and minimal correlation to traditional capital market investments.

- The political support for new energy capacity is unbroken, the regulatory situation has been stable in most markets and transparency is increasing.

- High need, especially in Eastern-Europe, for both energy production and handling the household waste situation.

Investments in renewable energy and waste disposal worldwide

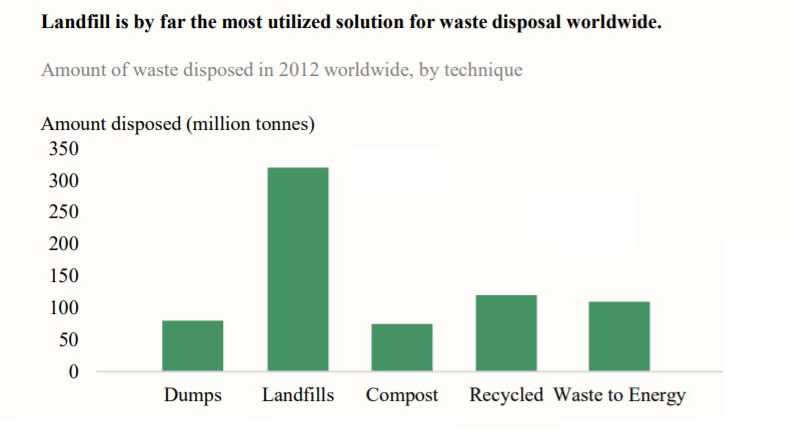

Europe is the largest and most sophisticated market for WTE technologies, accounting for 47.6% of global market revenue in 2013. Increasing industrial waste, coupled with stringent EU-wide waste legislation have been the major drivers for the EU and European market. Switzerland, Germany, Sweden, Austria and the Netherlands are most prominent the installation capacity within Europe.

The Asia-Pacific market is dominated by Japan, which uses up to 60% of its solid waste for incineration. However, the fastest market growth has been in China, which has more than doubled its WTE capacity between period 2011-2015.

The development of the WTE market has been driven by several different drivers. These drivers include increasing use of renewable energy resources, increasing amounts of waste generation globally, waste management regulations, taxes and subsidies, climate change policies to curb GHG emissions, technological advancements, access to talent, new financing opportunities, new global trends such as low fossil fuel prices, environmental degradation, circular economy, green business models, industrial symbiosis (companies that work in partnerships to share resources) and improved public perception of WTE.

As modern society moves towards an increasing level of urbanization, and with a growing population that demands greater consumption of goods and greater energy needs, the topic of waste management and energy recovery from waste becomes central for future scenarios of sustainable development.

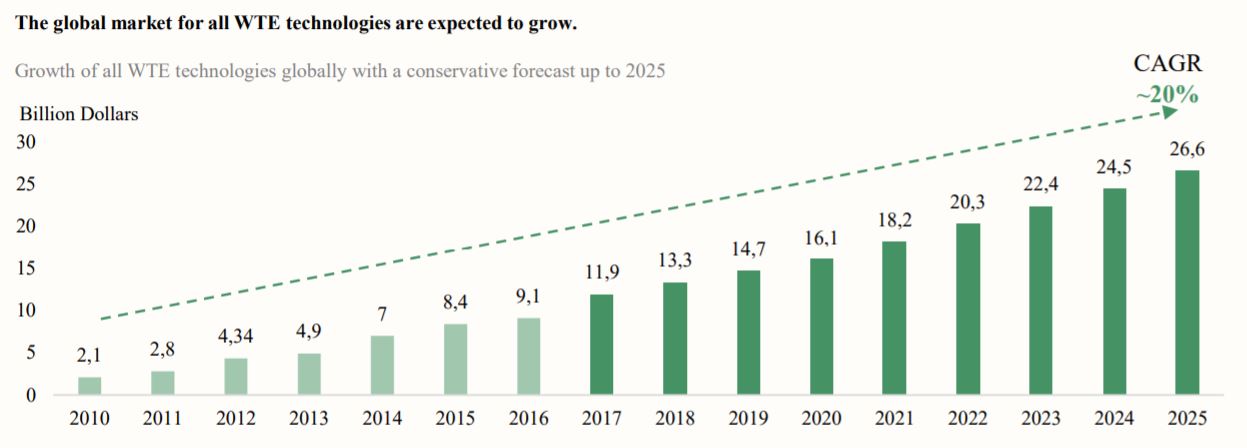

The global market is expected to maintain a steady growth to 2023, when it is estimated it could be worth USD40 bn, growing at a CAGR of over 5.5% from 2016 to 2023.

The figure below shows that globally all WTE technologies will grow significantly even in conservative forecasts up to 2025.

Renewable energy is still, despite its massive growth over the last decade and the impacts of the financial crisis in Europe and the US, a dynamic investment field for both yield and value investors.

The yields in the broader fixed income markets have over a long period been at historical lows, driving investors to exotic alternatives to get needed returns. The volatility of the stock market, in combination with placement restrictions, is driving long-term money in search of other sources of business.

Energy production is to a great extent not correlated to other asset classes. Energy production has attractive risk-adjusted returns, low volatility and minimal correlation to traditional capital market investments. The political support for new energy capacity is unbroken, and the regulatory situation has been stable in most markets and transparency is increasing.

The table below demonstrates the scale of the opportunity within Eastern Europe, with most countries in this region having renewable targets that are unfulfilled.

The following areas are:

- Green: portion of waste in EU that is recycled

- Yellow: portion of waste in EU that is incinerated

- Grey: portion of waste in EU that is placed on a landfill

As illustrated by the “grey areas”, there is a high need, especially in Eastern-Europe, for both energy production and handling the household waste situation.